IRS Tax Information

We have compiled a list of frequently asked questions and general information about the tax process such as 'How long does it take to process my claim?', and 'How do I prove my casino losses?' These and other questions are answered here.

(Click question to view the answer)

How long does the IRS take to process a claim?

The IRS begins processing the tax returns from the time they receive your submission. They can take between two and six months to process the claim and issue your casino tax refund.

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a US taxpayer number identifying you to the IRS. This is a required tax number to make a claim for a refund of your US casino taxes. If you do not have a tax number you must apply for this number when you submit your casino tax return.

How long does it take the IRS to process an application for an Individual Taxpayer Identification Number (ITIN)?

After your application is complete and it is determined you qualify for an ITIN you will be mailed a letter from the IRS assigning your tax identification number in 6 to 8 weeks.

Is there an expiry date for the US tax filings?

Yes, there is a three year statute on US tax filings. For example: To file a 2015 casino tax claim you must have the return submitted before the expiry date of June 15, 2019.

Will my ITIN expire?

YES

If you have not filed a U.S. tax return for the three prior tax years. Example: You have a casino tax claim to file for the coming 2023 tax year, but haven’t filed a tax return for tax years 2020, 2021 or 2022. In this case you would need to file a renewal for your ITIN.

NOTE: You have to file a tax return or an exception to renew your ITIN.

If you want to know if your ITIN is expired you can contact us by email for information at support@1042stax.com or you can go to the IRS website.

Do you offer other services besides casino tax filings?

Yes, our company does offer services for other U.S. tax matters. We are an IRS approved Certifying Acceptance Agent who can certify your identification for a W-7 application.

We also specialize in the recovery of U.S. taxes from the following types of income:

- U.S. Royalty Income (i.e. music sales, book sales, etc.)

- U.S. Pension & Annuity Income (private pensions and annuities)

- U.S. Investment Income (i.e. dividends, capital gains, rental income, etc.)

Please contact us toll free at 1-833-213-9526 or by email at support@1042stax.com for more details.

Should I make copies of my information?

Yes, you should always make copies of everything you submit to the IRS. Things get lost in the mail or misplaced so it's good to have a back up.

How do I prove my gambling losses?

The amount of your refund is determined by your losses. You must be able to show the IRS that you lost more gambling for a full refund of your taxes. If you won more than what you lost you will only be eligible for a partial recovery of the taxes. You can use your wins and losses from an entire calendar year (Jan 1 to Dec 31) to determine if you are at a win or a loss.

NOTE: You can only use losses from the year you were taxed.

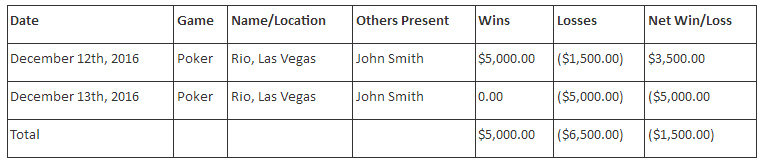

The IRS will accept a diary of your winnings and losses. Your diary should contain the following information:

- The date of winnings and losses

- The Type of game (i.e. slots, poker, lottery tickets, etc.)

- The name and location of the gambling establishment

- The names of other persons present with you

- The amounts you won or lost

Example:

(click image to open image in new window if too small to read)

What tax information should I keep?

- Win/Loss tax statements

- Betting slips

- Tournament buy-in receipts

- Lottery tickets

- Receipts from cashing cheques at the casino

- ATM withdrawal receipts

- Bank / credit card statements

- Poker players: keep your buy-in receipts from tournaments and a diary of money won and lost in cash games in the USA

NOTE:

You cannot use losses from the following games as they are exempt from tax:

- Blackjack

- Baccarat

- Craps

- Roulette

- The Big-6 / Wheel of Fortune

If the casino deducted tax on an exempt game you are entitled to a complete refund of those withholding amounts without having to prove your losses.