Blog

US Casino Tax Recovery for Canadians

Dec 12, 2018

![]() If you win a US gambling jackpot across the border you may be in for a surprise because although gambling winnings are not taxable here in Canada they are in the US, at a rate of 30 percent. US federal withholding tax automatically kicks in whenever a gambler wins $1,200 or more in a jackpot payout. The 1042-S form is given to US non-resident jackpot winners so they can file to recover their withheld US gambling taxes from the IRS.

If you win a US gambling jackpot across the border you may be in for a surprise because although gambling winnings are not taxable here in Canada they are in the US, at a rate of 30 percent. US federal withholding tax automatically kicks in whenever a gambler wins $1,200 or more in a jackpot payout. The 1042-S form is given to US non-resident jackpot winners so they can file to recover their withheld US gambling taxes from the IRS.

Increasing Your 1042-S Refund Chances

Nov 11, 2018

Some may think the title of this piece refers to ways in which to win more in US casinos so that the important items on your 1042-S forms, mainly jackpots, would be bigger but you would be mistaken as this is not the message here today.

Some may think the title of this piece refers to ways in which to win more in US casinos so that the important items on your 1042-S forms, mainly jackpots, would be bigger but you would be mistaken as this is not the message here today.

The 1042-S Form Explained

Nov 10, 2018

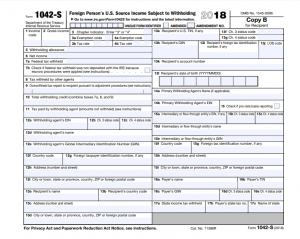

The 1042-S form is the means by which non-resident aliens report taxable income in the United States (U.S.) to the Internal Revenue Service (IRS). Hence the form is titled, ‘Foreign Person’s U.S. Source Income Subject to Withholding’.

What is an IRS Certifying Acceptance Agent?

June 27, 2019

A Certifying Acceptance Agent (CAA) is a person or an entity (business or organization) who, pursuant to a written agreement with the IRS, is authorized to assist individuals and other foreign persons who do not qualify for a Social Security Number but who still need a Taxpayer Identification Number (TIN) to file a Form 1040 and other tax schedules. The Certifying Acceptance Agent facilitates the application process by reviewing the necessary documents, authenticating the identity when able and forwarding the completed forms to IRS. [IRS]"

A Certifying Acceptance Agent (CAA) is a person or an entity (business or organization) who, pursuant to a written agreement with the IRS, is authorized to assist individuals and other foreign persons who do not qualify for a Social Security Number but who still need a Taxpayer Identification Number (TIN) to file a Form 1040 and other tax schedules. The Certifying Acceptance Agent facilitates the application process by reviewing the necessary documents, authenticating the identity when able and forwarding the completed forms to IRS. [IRS]"

What is an ITIN?

September 23, 2019

An Individual Taxpayer Identification Number (ITIN) is a 9 digit, U.S. taxpayer number which identifies you to the IRS as a taxpayer. This is a required tax number for any resident alien or non-resident individual who is filing a U.S. tax return (i.e. 1040-NR), claiming a refund or has need to reduce U.S. withholding tax by claiming a tax treaty benefit.

An Individual Taxpayer Identification Number (ITIN) is a 9 digit, U.S. taxpayer number which identifies you to the IRS as a taxpayer. This is a required tax number for any resident alien or non-resident individual who is filing a U.S. tax return (i.e. 1040-NR), claiming a refund or has need to reduce U.S. withholding tax by claiming a tax treaty benefit.

Keeping Track of Your Lossess

December 10, 2019

It’s never fun to think or see that you’re losing money gambling but the truth of the matter is your casino gambling records will help prove to the IRS that you’re eligible to claim back your 30% casino tax withholding.