What is the 1042-S Form?

What is the 1042-S Form?

Nov 10, 2018

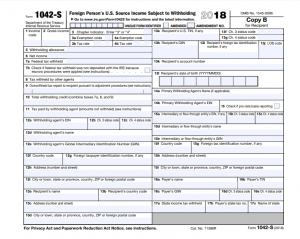

The 1042-S form is the means by which non-resident aliens report taxable income in the United States (U.S.) to the Internal Revenue Service (IRS). Hence the form is titled, ‘Foreign Person’s U.S. Source Income Subject to Withholding’.

The 1042-S form is used to report taxable U.S. income and corresponding withheld tax at source, as explained further in the following:

“Generally, every non-resident alien individual, non-resident alien fiduciary, and foreign corporation with United States income, including income that is effectively connected with the conduct of a trade or business in the United States, must file a United States income tax return.

However, no return is required to be filed by a non-resident alien individual, non-resident alien fiduciary, or foreign corporation if such person was not engaged in a trade or business in the United States at any time during the tax year and if the tax liability of such person was fully satisfied by the withholding of United States tax at the source.” [IRS]

This is the list of primary types of income that foreigners are subject to source withholding tax, are as follows:

- Interest

- Rents

- Royalties

- Compensation for independent personal services performed in the United States

- Annuities

- Pension distributions and other deferred income

- Insurance premiums

- Capital Gains (on real estate, stocks, etc.)

- Most gambling winnings

As you can see above, even certain gambling winnings are subject to U.S. withholding tax, however the good news is most countries have a treaty with the U.S. allowing them to recover these taxes. This is especially important for Canadians who may have unclaimed gambling tax claims.

This is where the 1042-S form comes into play for such reporting purposes. U.S. casinos issue 1042-S forms on gambling winnings and taxes paid on those winnings which are recoverable by filing the appropriate identification and tax related forms.

If you have such a need, or any other U.S. tax reporting need as a foreigner, we can be contacted at https://www.1042stax.com or by email at support@1042stax.com.