Keeping Track of Your Losses

It’s never fun to think or see that you’re losing money gambling but the truth of the matter is your casino gambling records will help prove to the IRS that you’re eligible to claim back your 30% casino tax withholding.

Canadians gambling in the United States (U.S.) are taxed 30% on their casino winnings and the amount of a casino tax refund you can claim is determined by your losses, which you’ll use to offset your casino winnings. You must be able to show the IRS that you lost more gambling for a full refund of your taxes.

If you won more than what you lost you will only be eligible for a partial recovery of the taxes. You can use your wins and losses from an entire calendar year (Jan 1 to Dec 31) to determine if you are at a win or a loss.

NOTE: You can only use losses from the year you were taxed.

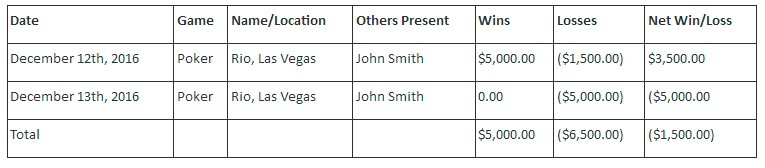

The IRS will accept a diary of your winnings and losses. Your diary should contain the following information:

- The date of winnings and losses

- The Type of game (i.e. slots, poker, lottery tickets, etc.)

- The name and location of the gambling establishment

- The names of other persons present with you

- The amounts you won or lost

Example:

In addition to a win/loss journal you’ll likely need to provide proof to back it up. Some great sources of proof include:

- Win/Loss tax statements – You can access most statements online these days but you can also contact your casino players club to request a statement.

- Betting slips

- Tournament buy-in receipts

- Lottery tickets

- Receipts from cashing cheques at the casino

- ATM withdrawal receipts

- Bank / credit card statements

- Poker players: keep your buy-in receipts from tournaments and a diary of money won and lost in cash games in the USA

Keeping Track of Your Losses